Business Services

Travel Services - Before January 1, 2024

Travel related questions may be directed to Business Services at 309-298-1811 or via email at Travel-Services@wiu.edu.

- Authorization to Charge

- Currency Conversion (Note: use YYYY-MM-DD format in date field)

- Foreign Travel

-

Lodging

- Club Quarters - Special rates for Western Illinois University travelers have been negotiated with Club Quarters and must be obtained through the following link: https://clubquartershotels.com/western-illinois-university

- Per Diem Calculator

- Per Diem/Meals

- Preferred Hotel Listing

- Reimbursable/Non-reimbursable Expenses

- Reimbursement Policy

- Request for Travel

- PCard

- Travel Advances

- Transportation

- Business Services Forms

- Travel Voucher Checklist

- Travel Voucher Instructions

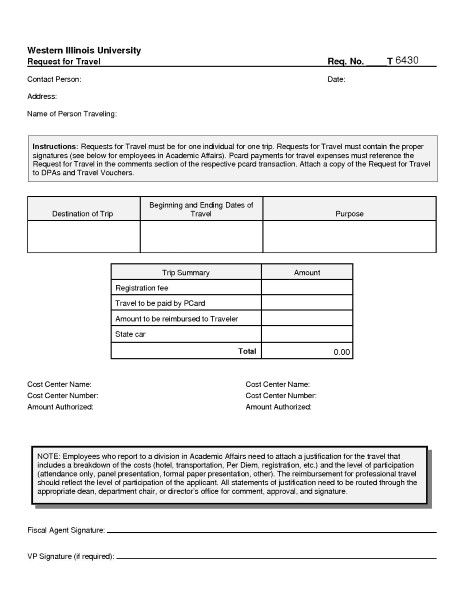

Request for Travel

This form is not required for reimbursement of travel expenses but can be used if the funds need to be encumbered for future trips. The form should be used for only one trip per traveler and needs to be received in the Travel Services office a minimum of seven days prior to the travel date. NOTE: Any Request for Travel outstanding 30 days beyond the concluding travel date will automatically be canceled.

Authorization to Charge

Departments wishing to have employee airfare paid directly by the University may do an Authorization to Charge with one of the Travel Agencies.

Contact a travel agency for an estimated cost of the ticket.

Prepare a DPA specifying the destination, estimated amount, travel agency, individual traveling, date of travel, and the purpose of travel.

Forward the DPA to the Travel Service Office in Sherman Hall 220. If the need is immediate, an Authorization to Charge Travel Tickets form will be processed while you wait. Otherwise, the form will be completed and returned by campus mail.

Once the Authorization to Charge Travel Tickets form is prepared by the Travel Services Office the traveler should present two copies to the travel agent.

When the travel is completed the traveler must attach the original passenger receipt and a copy of the Authorization to Charge form to the Travel Voucher. The amount of the tickets should not be included on the Travel Voucher for reimbursement. If the passengers receipt is not received within ten days after the date of travel, the department may be denied any future authorizations to charge.

PCard

The PCard can be used to pay for airfare, lodging, parking, shuttles, rental vehicle, and other specified travel expenses, but cannot be used to purchase meals while in travel status.

PCards may not be used for meals.

The original receipts must be attached to the Travel Voucher and must also be scanned and attached to the applicable pcard transaction in Paymentnet.

Please complete the PCard section of the Travel Voucher for any expenses purchased with the PCard.

Reimbursement Policy

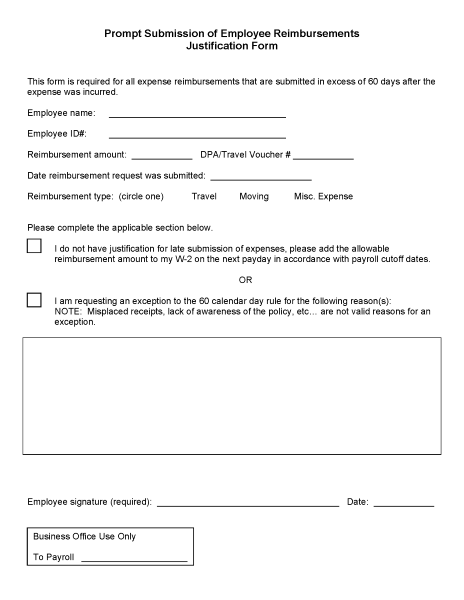

IRS Publication 535 indicates that reimbursements to employees for deductible expenses incurred while performing services are not taxable if 1) paid or incurred while performing services as an employee, 2) adequately accounted for within a reasonable period of time. A reasonable period of time is defined as within 60 days after the expenses were paid or incurred.

If reimbursements are not submitted within the 60 calendar day time frames above, the reimbursement amount will be paid in full but will be submitted to the Payroll Office whereby it will be reported as additional income and payroll taxes will be withheld.

Instances where it is impossible to submit a reimbursement request within 60 calendar days will require a Prompt Submission of Employee Reimbursement Justification form for additional documentation stating the reason the reimbursement could not be requested in a timely manner.

Business Services determines whether or not to recommend an exception. If an exception is recommended, the Promt Submission of Employee Reimbursement Justification is forwarded to the area Vice President and the Vice President of Finance and Administration for final signatures.

Transportation

All travel shall be by the most economical mode of transportation available. Should an employee choose to drive a personal vehicle rather than fly, the employee will be required to provide documentation/justification demonstrating it was more economical to drive than to fly.

When traveling by automobile, the preferred method is a State vehicle followed by a rental vehicle then a personal vehicle.

State Vehicle

The utilization of a State vehicle is the preferred method of travel by automobile.

Please visit the Transportation Services Web Page: https://www.wiu.edu/transportation/index.php for the vehicle requisition form or to view vehicle rates.

Rental Vehicle

The rental of an automobile while on travel status is allowed, if circumstances require.

The business purpose of the rental vehicle must be included in the comments section of the travel voucher.

The most economical vehicle available must be rented while traveling. If the most economical vehicle is not selected, justification is required.

The collision damage waiver and personal accident insurance on rental vehicles are not reimbursable.

The use of toll devices is allowed when most economical. To determine the most economical, departments must estimate tolls and compare the toll cost to the rental of a toll device.

The University has entered into an agreement with Enterprise for vehicle rental. When renting a vehicle, Enterprise is the preferred vendor. To reserve an Enterprise vehicle, please visit https://www.wiu.edu/purchasing-secure/_documents/secure/carrental.php and log in using your ECOM username and password.

Personal Vehicle

All travel shall be by the most direct route. Expenses due to deviations for convenience shall be borne by the employee.

Reimbursement for use of a personal vehicle shall be on a mileage basis.

Reimbursement for the use of a personal automobile is $0.655 per mile effective 01/01/2023.

Google Maps is the program used for obtaining allowable mileage.

All employees are required to complete the online vehicle certification before being reimbursed for travel expenses related to personal vehicle use. Completing the online certification is simple - login to WIUP on the web, type VINC in the display box, read the certification information, and, if you can agree to the information, select agree. The certification only needs to be completed once per fiscal year. If for any reason you can no longer comply with the certification, please contact Business Services.

Grad Assistants and Students must submit the appropriate paper vehicle certification form located under the Travel Forms section.

Airfare

Airfare may be purchased by PCard, Authorization to Charge or reimbursed after the fact.

The passenger receipt or e-ticket must be attached to the travel voucher before a traveler will be reimbursed. The airfare receipt must show proof of payment.

Baggage fees are allowable. If requesting payment for more than one baggage fee an explanation is required.

Early check-in, seat assignment, and insurance fees are not allowable.

Amtrak

Western Illinois University employees are entitled to receive the Government/Illinois State rate ($22 each way) when traveling between Macomb and Chicago on University business.

The Government/Illinois State rate is available for travel Monday through Friday. State employees traveling on Saturday or Sunday will be subject to the available fare at that particular time.

The Government/State rate can be obtained from a travel agent or by contacting Amtrak directly.

To contact Amtrak directly, phone (1-800-USA-RAIL), speak to an agent, and obtain a reservation number. The reservation number along with your WIU ID and payment will need to be provided to the conductor prior to boarding the train.

NOTE: Credit cards are accepted by the conductor for amounts of $25 and over. Therefore, if purchasing a one-way ticket directly from Amtrak, payment must be made in cash.

Please remember that the Government/Illinois State rate is to be used when traveling on University business only and is not to be used for personal travel.

Lodging

|

$60 before 7/1/19 $75 effective 7/1/19 |

Downstate (general) (To include area surrouding Southern Illinois University, Carbondale, Eastern Illinois University and Northern Illinois University) |

|

$70 before 7/1/19 $85 effective 7/1/19 |

Downstate Illinois (Champaign, Kankakee, LaSalle, McLean, Macon, Madison, Peoria, Rock Island, St. Clair, Sangamon, Tazewell and Winnebago Counties) |

|

$80 before 7/1/19 $95 effective 7/1/19 |

Chicago Metro (DuPage, Kane, Lake McHenry, Will Counties) |

| see below | Chicago Metro Cook County (to include the area surrounding Governor's State University, University of Illinois, Chicago and Northeastern Illinois University) |

| $110 | Out-of-state |

| See below | District of Columbia (Washington, DC) Also includes the cities of Alexandria, Falls Church, and Fairfax and the counties of Arlington, Loudoun, and Fairfax in Virginia and the counties of Montgomery and Prince Georges in Maryland.) |

| Out-of-country (See US Department of State Foreign Travel website) |

| Cook County | |

|---|---|

| Apr 1, 2023 - June 30, 2023 | $216.00 |

| July 1, 2023 - Aug 31, 2023 | $187.00 |

| Sep 1, 2023 - Sep 30, 2023 | $218.00 |

| Oct 1, 2023 - Nov 30, 2023 | $233.00 |

| Dec 1, 2023 - Mar 31, 2024 | $146.00 |

| Apr 1, 2024 - Jun 30, 2024 | $216.00 |

| July 1, 2024 - Aug 31, 2024 | $213.00 |

| Sep 1, 2024 - Sep 30, 2024 | $233.00 |

| Washington, D.C. | |

|---|---|

| Mar 1, 2023 - June 30, 2023 | $258.00 |

| July 1, 2023 - Aug 31, 2023 | $172.00 |

| Sep 1, 2023 - Sep 30, 2023 | $257.00 |

| Oct 1, 2023 - Oct 31, 2023 | $261.00 |

| Nov 1, 2023 - Feb 29, 2024 | $193.00 |

| Mar 1, 2024 - Jun 30, 2024 | $258.00 |

| July 1, 2024 - Aug 31, 2024 | $176.00 |

| Sep 1, 2024 - Sep 30, 2024 | $261.00 |

A list of preferred hotels is available. (See the Preferred Hotel Listing). Many hotels in the Preferred Hotel Listing offer state rates based on room availability. Hotels are not obligated to always offer the state rate.

Reservations should be made as far in advance as possible. Always ask the hotel about its cancellation policy. In busier times, cancellation policies will sometimes require the traveler to cancel 72 hours in advance or be charged for the room. If you must cancel a reservation, do so before the deadline. If you make a reservation for several nights in succession ask the hotel about their early check-out policy. Some hotels charge an early check-out fee if a guest checks out prior to their scheduled departure date.

Confirm that the “state” rate will be received. This should be done when making the reservation, when checking-in and when checking-out. Make certain the “state” rate quoted is within the maximum allowable lodging rate for the area.

Carefully review the bill upon check-out to ensure that the room charge reflects the appropriate rate and that no unauthorized charges have been added. For example, some hotels will automatically add a security charge or phone usage charge to your bill. If these services are not used, the charges should be removed before checking-out.

If paying by PCard or direct billing the University be sure all personal or incidental charges are paid when checking-out (i.e., movies, meals, personal calls , etc.)

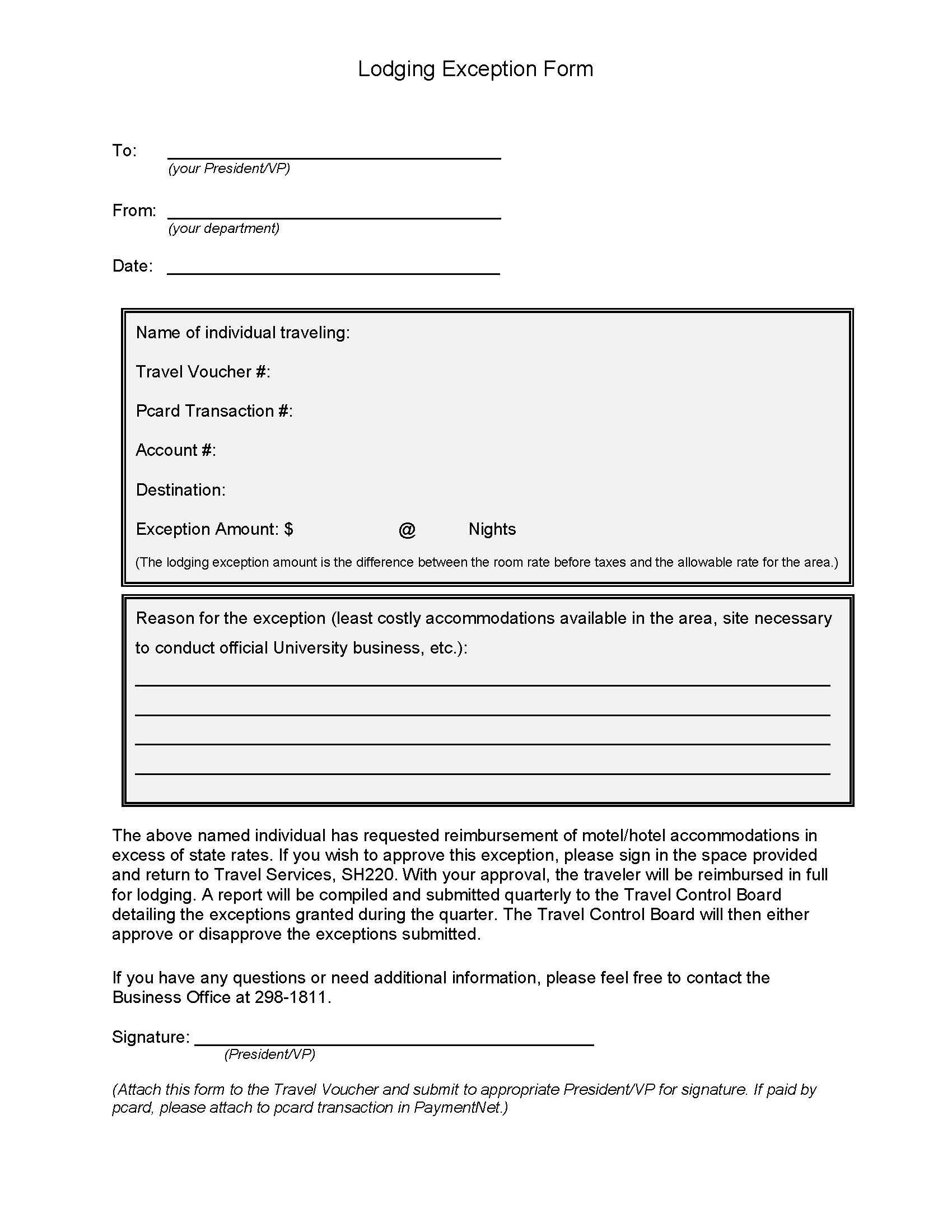

If a traveler stays at a hotel where the hotel rate exceeds the allowable rate, a Lodging Exception form must be completed and approved by the appropriate vice president. The lodging exception amount is the difference between the room rate before taxes and the allowable rate for the area. Provided the respective vice president approves the exception, the traveler will be reimbursed for the full amount of the lodging. A copy of a brochure or a meeting registration form which indicates the hotel in which the meeting was held is acceptable documentation in place of a Lodging Exception form.

Lodging exceptions are compiled, presented, and approved quarterly by the Higher Education Travel Control Board. Should the Higher Education Travel Control Board choose to disallow lodging exceptions, the traveler will be responsible for reimbursing the University.

Per Diem/Meals

Per Diem

Travel period must be overnight or in excess of 18 hours to qualify for per diem.

Per diem

In-state rate is $11.00 per quarter day and out-of-state rate is $12.00 per quarter day.

Quarter days are as follows:

- 12:00 midnight - 6am

- 6am to 12:00 noon

- 12:00 noon to 6pm

- 6pm to 12:00 midnight

Meal Allowance

Travel of 18 hours or less during the same calendar day or when a night's lodging is not required.

| In-State | Out-of-State | |

|---|---|---|

| Breakfast - must leave before 6am | $8.50 | $9.50 |

| Lunch | no allowance | no allowance |

| Dinner - must return at or after 7pm | $23.00 | $25.00 |

Deductions for Meals Provided

When the cost of meals is a part of a registration fee or part of airline or hotel arrangements and paid or reimbursed by Western, the traveler must deduct the following amounts from the per diem or per meal allowance:

| In-State | Out-of-State | |

|---|---|---|

| Breakfast | $8.50 | $9.50 |

| Lunch | $12.50 | $13.50 |

| Dinner | $23.00 | $25.00 |

Foreign Travel

The U.S. Department of State foreign per diem rates established separate amounts for lodging and meals plus incidental travel expenses (M&IE). The maximum lodging amount is intended to substantially cover the cost of lodging at adequate, suitable and moderately priced facilities. When the traveler is claiming the U.S. Department of State foreign per diem rates the following incidental expenses are also included in the M&IE per diem rates:

- Charges for meals

- Personal use of room and bath during daytime.

- Fees and tips to waiters, porters, baggage handlers, bellhops, hotel servants, dining room stewards, and similar employees.

- Telegrams, telephone calls and internet services

- Laundry, dry cleaning, and pressing of clothing.

- Fans, air conditioning, heating, radio, or television in rooms.

- Transportation between place of lodging or business and places off site to obtain meals when they are not obtainable within the immediate vicinity.

See the U.S. Department of State Foreign Per Diem Rates website for more information.

When the cost of meals is a part of a registration fee or part of airline or hotel arrangements and paid or reimbursed by Western, the traveler shall deduct the following amounts from the per diem or per meal allowance:

| Out of Country | |

|

Breakfast |

15% of M&IE Rate |

|

Lunch |

25% of M&IE Rate |

|

Dinner |

40% of M&IE Rate |

Reimbursable and Non-reimbursable Expenses

The cost of business related special expenses, if reasonable, shall be reimbursable. Examples are:

- Hire of room, exhibit space, set up and such for official business

- Laundry and dry cleaning if on travel status for at least seven consecutive days

- Storage and handling of baggage

- Taxis including reasonable tips

- Housekeeping gratuity

- Telephone calls on official business including calls up to $10 to announce safe arrival or delay-change in plans

- Telephone calls to secure lodging

- Internet charges for business use

Examples of non-reimbursable expenses are:

- Alcoholic beverages

- Coat check

- Entertainment

- Late check-out or early check-in room charges and room guarantee charges

- Early check-in, seat assignment, and insurance fees

- Meals for other State employees

- Parking tickets or other traffic tickets

- Transportation to procure meals

- Tips incurred beyond those specifically provided in this part

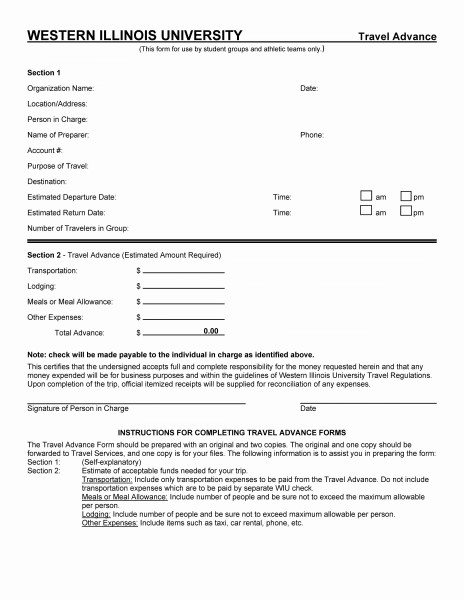

Travel Advances

Group trips involving more than one student (i.e., athletics, livestock judging, study abroad, etc.) are eligible for a travel advance.

The advance must be payable to an employee that is in charge of the trip.

The advance form and a DPA payable to the employee in charge of the trip must be submitted to the Travel Services Office.

A form to aid in reconciliation will be included with the advance check. All Travel Advances issued must be reconciled within 7 days of return. No other travel advances will be issued until outstanding advances are cleared up.

Funds cannot be advanced to employees for travel. Employees are expected to utilize PCards for the payment of travel related services (excluding meals) OR use personal funds and submit a travel voucher for reimbursement within 60 days of the ending date of travel.

Accounts Payable

Processes DPAs and Travel Vouchers

Forms

- Direct Pay Authorization (select WIUP, then DPAU)

- DPAU Instructions

- Travel Voucher

- Travel Voucher - Non-Employee

- All Other Forms

Connect with us: